Much of what we hear about cryptocurrencies comes from the Global North or some small island nations in the Pacific or the Caribbean (whatever territory wins the lottery to become the next Cryptoland). That’s why I thought it would be a good idea to speak to Edemilson Paraná, a Brazilian sociologist who has published widely on the rise of digitsed finance, with a particular focus on how digital technologies were transforming the Brazilian finance industry.

Having read Paraná’s 2016 book on the subject, I was pleasantly surprised to discover that he has also recently published a book about Bitcoin and how we should think about crypto-currencies in light of their emergence in the wake of the 2008 financial crisis. Called Bitcoin: a utopia tecnocrática do dinheiro apolítico, it came out in Brazil in 2020. My Portuguese is good enough, so I enjoyed reading it in the original; the rest of you might have to wait for the English translation coming from Brill.

Our conversation starts off with Paraná articulating his broader theory of how digital technologies and modern finance relate to each other. We then proceed to discuss the ideological origins of Bitcoin; how cryptocurrencies mobilize the digital to “de-virtualize” money; why Brazil is likely to introduce its own Central Bank Digital Currency, but also why it might not be as progressive as one might think; and, finally, the composition of crypto-boosters in the country.

~Evgeny Morozov

Before we get to crypto, let's outline some of your general views on finance, technology, capitalism. For example, your early work discusses a broad shift from the post-war regime of accumulation that we know as Fordism-Keynesianism to the contemporary one dominated by finance. You identify digital technologies as one the main enabling factors behind this shift. How exactly do digital technologies fit into the new finance-led capitalism? Is it by providing stability or, rather, by creating new opportunities to extract profit, or, perhaps, in some other way?

There is certainly a structural causality between the development of digital technologies and the new dominance enacted by finance. For one, without these technologies, the special type of financialisation that took hold in the 1980s and still continues today would simply not be possible. Financialisation itself has evolved; it’s now increasingly data-centred and algorithmic. Without digital technologies, some of today’s financial instruments simply would not exist.

This is why my work refers to “digitalised finance”: the concept seeks to describe the new sociotechnical management system for the valorisation of financial capital. This valorisation occurs by deploying cutting-edge, automated technologies, which accelerate the compression of space-time flows to obtain short-term liquid financial gains on a global scale.

To paraphrase our Chinese comrades, one could say that this is a “financialisation with digital characteristics” or a “digitalisation with financial characteristics.” Its logic is that of creating new opportunities to extract profit and, definitely, not that of providing transparency and stability.

In your previous book, where you discussed the rise of dark pools and high-frequency trading, you wrote that the penetration of technology into the financial system leads to the proliferation of new risks and instabilities. How exactly does this happen?

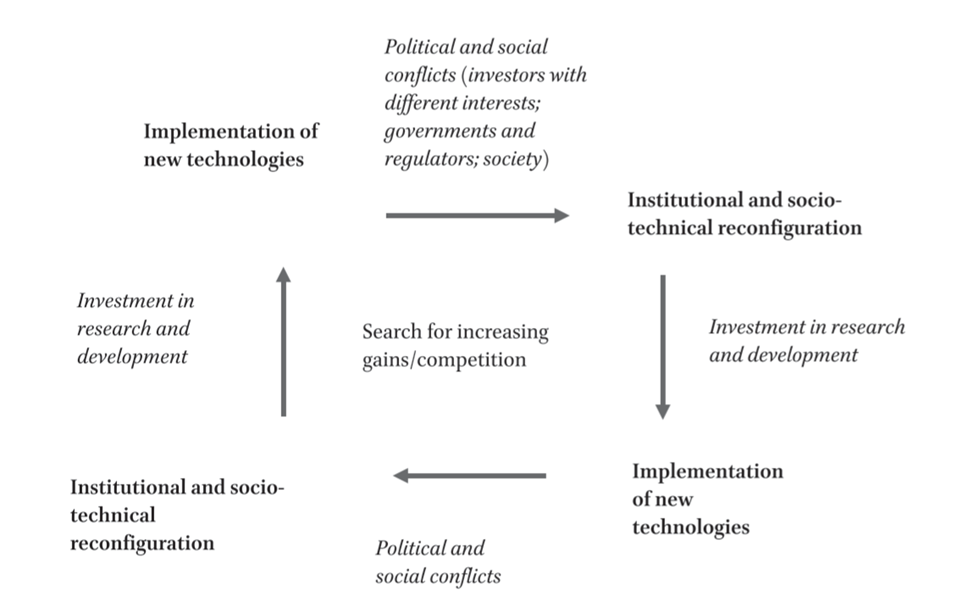

In my study of different financial markets, I observed the recurrence of a certain pattern that I’ve described as “the spiral of complexity of digitised finance.” This spiral is a feedback process that fuels the growing complexity of financial markets. As a result, many of the financial operators themselves – not to mention the regulators – don’t exactly know what is happening in the markets. The so-called “flash crashes,” where markets behave in strange and unexpected ways, are a good example.

The spiral illustrates how completely rational individual decisions could produce irrational social outcomes. There are three basic steps to it.

First, in highly digitalised finance, the search for unexploited financial gains incentivises leading players to invent, deploy, and refine the means needed to overcome the technological or regulatory obstacles that stand in the way of speculation. Second, the wide adoption of these new technologies leads to the emergence of new institutional configurations, new modes of action, and new operating dynamics; as a result, markets are reconfigured, partly in response to the political and social conflicts that erupt. Finally, the ensuing emergence of new institutional and technological environment encourages the development and implementation of even newer technical solutions. This cycle of growing complexity comes to entangle investors, regulators, tech companies, and other (often unwilling) participants. New systemic risks and instabilities proliferate as a result.

You also argued that digital technologies actually help consolidate the dominance of modern finance over our lives. Could you explain a little bit how exactly this happens?

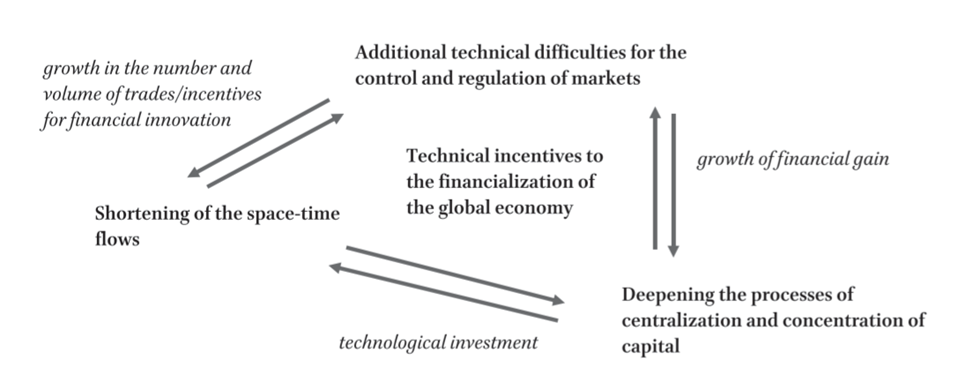

Perhaps I can invoke another concept to explain the dynamics involved: the “cycle of operations of digitalised finance.” As I’ve already said, the main impact that digital technologies have on the market is to shorten space-time flows, i.e. they make everything faster and nearer. This increases the number and volume of trade operations and transactions. The digital systems behind those trades and transactions are immensely complex, they operate at immense speed, and have tremendous learning and adaptive abilities. They make the job of regulating markets far more challenging; there is too much opacity and uncertainty involved. As regulators find themselves at a loss, there occurs further concentration and centralisation of capitals within and between markets: those with more advanced technologies enjoy higher profits, so it’s natural that such centralisation occurs. This entrenches the hegemony of financial capitalism.

In your previous book, you already alluded to the conditions of possibility behind the rise of crypto: as the global financial system became more unstable, opaque, and unpredictable – not least because of high-frequency trading and other innovations – it somehow needed to ground its operations in something that promised certainty, transparency, and predictability… Bitcoin and the blockchain provided just that. Could you say more about this?

In some sense, it is the actualisation of an old paradox. While capitalists need to amass information in order to tame uncertainty, they themselves want to live in a low-information environment, avoiding the scrutiny of consumers, citizens, governments, and the media, at least as far as their own profit-making strategies are concerned. So, businesses always want almost full transparency onto everyone but themselves. Their competitors – as well governments and technocrats – have similar goals, producing uncertain, risky, and rather “opaque” scenarios.

So, the struggle between these two tendencies – their particular combination in different contexts – is, in my view, the key to understanding information governance within capitalism. It expresses the fundamental capitalist contradiction, i.e. that production is a collective social process that, however, is privately conducted and controlled. Disputes over the control of information need to be approached this way. Since the underlying contradiction can never be properly resolved, all that these disputes can do is somehow precariously accommodate these self-canceling tendencies.

One obvious example is the “spiral of complexity” that I’ve already mentioned. It’s marked not only by a chaotic and uncontrollable dynamic but also by a highly confusing one: few experts and operators can actually navigate it well. The growing opacity of the markets becomes an element of control, leaving the management of strategic information in the hands of a closed elite of investors.

Governments and regulators, but also small investors, those acting on the edges, become increasingly dependent on large funds, brokers, and financial institutions to manage their investments. This is usually done with very little transparency. And all of this in the name of efficiency, stability, predictability. Opacity is the “other,” the truth of the capitalist transparency.

In your most recent book, you present Bitcoin as a weird consequence of the financial crisis of 2008, with its contradictory dynamics. In what ways has that financial crisis shaped the initial reception of Bitcoin as well as its subsequent development? After all, it has hardly blossomed into the means of payment that Nakamoto wanted it to be, triggering a massive “asset bubble” – not unlike those blamed for triggering many of the earlier financial crises…

Hitting the public radar after the 2008 crisis – and doing so at a time when the “really existing” neoliberalism was struggling with a serious crisis – the “anti-establishment” libertarianism of cryptocurrencies attests to the intensification of neoliberal ideology, all while illustrating its many problems, limitations, and contradictions as a practice of government. Bitcoin, thus, appears as one more aspect of the creeping zombie-neoliberalism in which we live, as a strident high-tech “morbid symptom” of our times.

In the book, I define Bitcoin as “neoliberalism's rebellious son.” It is well-known that many inside the Bitcoin community advocate the core ideas of neoliberalism (Milton Friedman’s monetarism, Friedrich Hayek’s catallaxy, etc.). At the same time, Bitcoin – and the broader anti-statist, radical, openly confrontational rhetoric around it – does embarrass many inside the “really existing” neoliberal establishment, with their “pragmatic” problem-solving.

It is true that the rise of Bitcoin – and the broader resurgence of the Austrian School – speaks volumes about the political mood of the post-2008 era. Presenting itself in opposition to the political establishment widely perceived as self-referential, corrupt, and undemocratic, Bitcoin claims to represent an allegedly “apolitical” and “honest” form of money. Ironically, cryptocurrencies like Bitcoin also come to exacerbate, in countless ways, the very principles of the neoliberal era, turbo-charging the process of the speculative assetisation of everything.

This is the boringly-obvious Oedipus tragedy of Bitcoin. It is as if this histrionic “rebellious child” of neoliberalism suddenly began demanding consistency from the father, the neoliberal establishment. After the financial crisis, the father was exposed as an old and vicious hypocrite, preaching one thing, but, in bailing out the banks, doing its exact opposite.

So, the libertarian radicalism of Bitcoin gains ground precisely by demanding, in a technocratic way, that neoliberalism fulfill its initial promises: promote competition as a way of generating “innovation,” defend individual property, advance the projects of commodification and privatisation, and so on. Bitcoin, despite its technically innovative aspects, is not much more than the transmutation of this very same agenda to the field of monetary management.

Your analysis of Bitcoin presents it as a combination of three ideological currents: neoliberalism; anti-establishment populism; technological utopianism. Do all these three ideologies add up to a coherent common project, and if so, what is it?

In my view, the structural core of the Bitcoin ideology is represented by the theoretical principle, so important to economic orthodoxy, that money is and must remain neutral. The same ideology holds that money, as a creature of the market, is merely a veil, a lubricant, a technical enabler, and a vehicle for commodity exchange. In this view, money is a “thing” that, due to its particular qualities, comes to perform its specific functions in the market. Money, on this view, must be regulated – or, better, self-regulated – via the market itself.

Accordingly, something like inflation is recast as a tyrannical way of eroding individual property to promote serfdom; it’s always seen as a monetary phenomenon, which arises, by and large, from the external intervention in the monetary realm by – who else? – the terrifying figure of the State. The latter represents authoritarian collectivism: a vicious and inefficient political invasion of what would otherwise be the purely technical, functional existence of money. This is the fantasy that unites many neoliberals, the anti-establishment populists, and the technological utopians associated behind Bitcoin.

Another very astute observation in your analysis of crypto-supporters has to do with their insistence that the political and the economic could be cleanly separated, so that the economic would be managed by the algorithmic systems that rely on the laws of mathematics and physics rather than on trust and politics and all this dirty human business. Do you think this tendency to see the two as separate originates in neoliberal or technocratic thought? I suppose someone like Hayek, with his insistence on “dethroning politics,” might very well agree on the need to keep the political out of the economic as much as possible. But someone like Thorstein Veblen, with his belief in the power of engineers, might actually believe that too…

Technological determinism and economic liberalism tend to walk together, although they are not the same thing. We can trace this back even to David Ricardo and his contemporaries: markets and money are a matter of self-regulation, it’s a technical question that should not be corroded by politics and values, we should resolve it without discussing values, beliefs, culture, history, institutions, common goals and understandings, social needs and so on. All that matters are transhistorical markets and individuals, with their magically neutral autonomous technologies; only they constitute the road to liberty and prosperity.

Sure, there are all sorts of nuances in terms of how these principles are combined in various forms of liberalism, but, to various degrees, they are always present. The political must be out, it has nothing to do with the economic; they have to be clearly separated and the border between them has to be policed. This is, by the way, where technology enters the picture. Not only in terms of enabling “innovation” and “creative destruction” but also as a way of materialising proprietary colonial paranoia against the social, against everything that cannot be encapsulated in terms of the market and its rationality.

It is hardly a coincidence that Milton Friedman himself suggested, in the early 1990s, that the Federal Reserve was to be replaced by a computer, programmed to automatically increase the money supply based on projections of population growth. This way, the need for economic policy would be extinguished – along with the need to maintain something like a Central Bank.

Well, in certain sense, it is exactly what Bitcoin has tried to realise in its utopia of programmable money. However, contrary to the beliefs of neoliberals like Friedman, money is a social relation, not a thing. As such, it doesn’t matter whether it’s physical or not, whether it’s paper, silver, or digits on the screen: in a certain sense, it is already “virtual” – otherwise, it could not properly function as money. The “virtuality” of money has nothing to do with its “digitality.”

What Bitcoin tries to do is deploy digital technologies to “de-virtualise” money, that is, to turn it from a “social relation” into a “thing.” That this thing is bound to be “digital” should not distract us from grasping the underlying objective. In this sense, the Bitcoin ideology is not that different from the imaginary that gave us the gold bugs and the money metalists. Again, this is no coincidence that so much of its technical language is based on the physicalist metaphors related to gold: to mine, to mint, to dig, so on. Bitcoin is digital metalism.

Building on your earlier argument about cryptocurrencies also serving a certain legitimating function for global capitalism, could one say that, in retrospect, the chief contribution of Bitcoin in these past 13 years has been to keep the mainstream critique of capitalism – and of central banking – that blossomed in the post-2008 environment strictly within systemic contours, i.e. without actually challenging capitalism as such? It’s hard to see Wall Street and the financial system feeling particularly anxious when all of the anti-systemic anger gets vented through Reddit communities such as WallStreetBets, with money flowing to Robinhood and various so-called DeFi apps? How do you see this playing out in Brazil?

Yes, it is true. And it is very striking to see this happening in Brazil, a huge and complex country full of very interesting but also tragic contradictions. When I launched my first book on Digitalised Finance, in 2016, I made a book tour through various Brazilian cities. Given the nature of the subject, most of these conferences were in the business and economic schools of important universities.

The Brazilian university environment, especially that of the public universities, was, for decades, even during the hard times of the dictatorship, traditionally progressive. Although these tend to be more conservative, this also applies to some important economic schools as we have had a strong tradition of influential heterodox economists in the country. And here I am, debating on digital financialisation with mature scholars who were way more progressive in content than their young, (at least formally) rebellious students. The latter, in their shining freshmen eyes, always asked me, everywhere, about Bitcoin, cryptocurrencies, and the like. Some would go further, debating Hayek, Mises, and such. Worse than that, when giving talks to unions and left political organisations, I often saw people there do the same.

It was clear to me that something serious was happening so I decided to devote myself to explaining this. Not surprisingly, 2016 is the year, as pointed out by many, of the debut of Jair Bolsonaro as an outsider presidential candidate, during President’s Dilma impeachment, when, announcing his vote in favor of impeachment in the Parliament, he saluted Ms. Rousseff’s former torturer in the dictatorship years. It was not very difficult to connect the dots.

All financial market people in Brazil soon embraced him with open arms, especially the new generation of scholars who work in the tradition of Austrian economics – they were the first! – and the crypto-enthusiasts. Their lunatic rhetoric was rather familiar: everything was the government’s fault; all except hardcore neoliberals were communists; the country was on the verge of full-fledged socialism. Some of them would later be invited to the government by Bolsonaro’s new Economics Minister, Paulo Guedes, a Chicago Boy financier who worked with Pinochet in Chile.

Given this, the crypto-hype in Brazil is almost fully driven by the hardcore right-wingers. Many of them, of course, rely on generous ideological, logistical, and financial support from American conservative think-tanks and libertarian organisations, as is very well documented by now. That said, it is also true that Bitcoin does pose some interesting and sometimes insurmountable challenges to big banks, governments, and international financial institutions. And this paradox needs to be taken seriously.

Brazil, under Bolsonaro, has proved to be particularly receptive to the Mises Institute and various other free market institutions; there seem to be plenty of such communities online. How much are they into crypto? Have they managed to make any truly novel arguments against central banking (and government in general) or do they stick to the conventional talking points? What are their main policy demands when it comes to the regulation of crypto, both in terms of investments and mining operations? Who are their main supporters in the Bolsonaro administration?

I would say there are two layers of crypto-enthusiasts in Brazil. The first comprises young geeks, tech aficionados, social media warriors, engineers, tech people, and so on. This is not unique to Brazil as we find these types everywhere. They tend to be more idealistic and somehow naïve; they are often joined by the mostly white, upper-middle-class males in their thirties – often investors and developers.

The other layer is made by people who are making, in different ways, significant amounts of money off crypto. These people are placed in emerging FinTech and financial institutions, some of them huge ones, propagating crypto-evangelism by selling books and “investment courses” and, most commonly, investing in or selling some type of crypto-product or crypto-scheme. And here, in this second layer, you have a subdivision: those who are openly criminal, building various pyramid schemes; and those who are legitimate, working for brokers, exchanges, app producers, fee collectors of any sort, as part of this growing crypto-ecosystem in Brazil. Some representatives of this legit branch of the business form part of the revolving door that connects Bolsonaro’s Economic Ministry to the big financial institutions in the country.

This second layer mostly preys on a growing mass of people, exposed to years of neoliberal reforms, who are desperate to make some money out of their declining personal savings in a time of crisis. These people, many of them recently unemployed, nurture the dream of becoming suddenly rich by speculating on crypto, often to supplement their declining incomes.

This whole environment doesn’t make much room for truly novel arguments against central banking and governments, as they are not very much interested in that in the first place. They want, above all, to make money. So, they mainly reproduce the well-known talking points. There is not a single, as I recall, distinguished Austrian economist or intellectual who is scholarly recognised in Brazil, even though, with the help of American organisations, some might soon emerge. Their main policy demands are built around something like “leave me alone and let me make my money,” trying whenever possible to be granted some privilege or support – even from the government – for their agenda and their business.

Following the example of El Salvador, some politicians in Brazil want to make Bitcoin legal tender. Using bitcoins to "buy a house, a car, go to McDonald's to buy a hamburger," to quote one federal deputy, Aureo Ribeiro. Is this a fringe debate in the country or is it something worth taking seriously? What lessons could one draw from the El Salvador experience for the Brazilian case? Are there any worthwhile elements that you see there – like the Chivo wallet, for example?

I don’t think it is worth taking seriously, at least at this moment. Some structural factors explain this. The first, and the most important one, is that Brazil has a complex, strong, capitalised, and technologically advanced financial system, still relatively well-regulated, and, above all, structured by some of the biggest banks in Latin America, two of them partially controlled by the State. These banks, especially the fully private ones, politically control the country’s Central Bank and the country’s monetary policy.

This, of course, is a problem, but, when it comes to crypto, it paradoxically offers a form of defense. This oligopolistic financial environment has proved challenging even for big international banks and Big Tech; they have trouble setting up financial operations in the country. So, while El Salvador’s Chivo wallet is certainly an interesting experiment in certain aspects, I don’t see it happening the same way in Brazil. I do think, however, that some kind of a digital wallet might eventually be launched, as a joint effort of private payment companies, big banks, and the central bank. This is the way things tend to happen in the Brazilian financial system.

Moreover, we still have a very well-equipped state bureaucracy, which has shown itself to be against making Bitcoin legal tender. Finally, we also have well-trained and influential economists, both on the left and the right, who offer daily resistance to such proposals; the mainstream media – and, with it, public opinion – have also become aware of how this space is being used to favor illicit practices. So, the main tendency right now is to let the game continue in the way it is and see what happens later. What some representatives of big money in the country – as suggested by Paulo Guedes, the Economic Minister – really wish to do is dollarize the Brazilian economy (which would surely be a tragedy), but even this is met with important resistance.

In short, I would say Brazil is closer to having its own Central Bank Digital Currency than to making Bitcoin legal tender. This, of course, doesn’t contradict the fact that this is a rapidly growing business in Brazil.

After the release of your latest book, you were harshly attacked on social media by various anarcho-capitalist militants. Could you explain how the public debate has evolved since your first interventions? Have you followed discussions and developments inside the online communities that defend crypto technologies from the right? Related to this, are there any online communities in Brazil that defend crypto from the left? It’s something of a growing industry, for reasons unknown, in the Anglo-Saxon world at least…

The relation of the crypto-world, be they technicians or financiers, with right-wing digital communities has contributed to somewhat weakening the organised left engagement with crypto, although there is still some involvement with blockchain initiatives, people experimenting with platform cooperatives and the like. The environment is changing because, for many reasons, the overall political climate is changing in the country. Somehow, the positive and the negative reactions to the book are contingent on that.

When the book was published, I was attacked not only by the anarcho-capitalists and crypto-evangelists but also by “laic people” that put their desperate hope on earning some money with this, people who invest, people who work in this industry, people who depend on this. Since then, many crypto-schemes are getting media coverage and landing people in jail in Brazil and, also, a significant number of these small investors lose their money or at least do not gain what was promised to them. The deepening epidemic, economic, and political crisis is, in part, opening the debate to more critical accounts. That said, Brazil is still a very fertile ground for cryptocurrencies and crypto-businesses and the narrative is still widely dominated by enthusiasts and propagandists who are certainly being successful in their job.

Do you see any value in leftist administrations – let’s say if Lula gets elected again in Brazil later this year – actually adopting the so-called Central Bank Digital Currencies (CBDCs)? Would they be able to pursue any kind of progressive agenda, or would this be very hard given the neoliberal re-orientation of the central bank under Bolsonaro?

Brazil revealed itself in the last decades as a country very open to the digital transformation of its banking and financial systems, as I discuss in my previous book. Brazilian commercial banks are known to have made very effective advances in this area, years ahead of most developed countries. The same has occured in its capital markets, which are regularly placed among some of the most technologically advanced in the world. And this is also a reality for public institutions such as the central bank and the revenue service, which are fully digitally integrated. Brazil recently implemented its own central bank digital payment system called PIX, a pioneering initiative in this area.

In sum, we have very well-trained engineers, plenty of know-how, the necessary resources, and a political and economic environment that welcomes these initiatives so as to control them on its own terms. And here lies the question: control. Because these initiatives are being conducted in a centralised manner, in full alliance with the interests of big private banks, we see a lot of cosmetic change that is there only to maintain the status quo. Some type of CBDC implementation is just a matter of time in Brazil. Alas, it is likely to go in this very same direction, that is, respecting the Brazilian tradition of “conservative modernisation.”

I’m convinced that CDBDs surely represent an interesting opportunity for a progressive agenda in various ways. But its technical and practical configurations would have to be designed to meet alternative political content and a different orientation of monetary policy and macro-management. This is the crucial challenge here. It surely is possible, but it will require a gigantic political effort, something that contradicts what has been happing for decades now in the country.

You’ve written, somewhat critically, of both Assange and Snowden as giving cover to the technological utopian part of Bitcoin. I can’t say I fully agree with your characterisation of them in the book but it’s hard to deny that, at least in the case of Assange, there’s a residue of the earlier cypherpunk ideology that informed his early views about Bitcoin. But it’s also hard not to sympathize with his position somewhat: given the US-led blockage on WikiLeaks’ finances, Bitcoin did offer the possibility for the organisation to keep operating. Wouldn’t this justify some of that utopianism? I’m also curious if you have read Edward Snowden’s recent essay about CBDCs? What do you make of the arguments in it?

In my defense, I do say in the book that Bitcoin, among other things, was used and will continue to be used for these purposes. This, surely, is something that must be considered.

However, the political invitation that I offer to the reader in the final chapter is the following: how to maintain the positive and promising aspects of Bitcoin and the blockchain while at the same time freeing us from its dystopian prediction of technocratic apolitical money, of an individualist market-based form of governance? I’m not saying that this is impossible, I’m saying this is very challenging and needs to be approached as such.

Bitcoin and cryptocurrencies already found a set of social needs to be met in the current capitalist world; it has its own social functions, its own use-value, so to speak, although different from those desired by its enthusiasts. In that sense, it is here to stay. Also, the existence of Bitcoin is, per se, promoting lots of changes, mostly in unforeseen directions, and these are really relevant, the emergence of CDBC being, in a certain aspect, one of them.

This leads us to Snowden’s arguments about it. More than wrong and short-sighted, it is at the same time impressively naïve about geopolitics, the complex and contradictory role of States, the autocratic aspects of market forces and big companies, as well as the realm of concrete political struggle, marked by unintended emergent consequences of multiple conflicts in different directions. It sure can take the cryptofascist direction he denounces, but it can also be developed in a different way depending on an alternative balance of forces.

A viewpoint grounded on technological determinism and individualistic liberalism as it is, it is not able to properly process these nuances and complexities. It is the crypto-anarchist Heaven or nothing; this or the digital totalitarian state Hell as its opposite. The admirable fact that they heroically sacrificed their own liberties for the cause of public liberty – and I do see them as such – does not make them correct on this topic. To have libertarian Snowdens and Assanges out there is very good indeed, but it would be even better to have progressive, democratic socialist equivalents of them.

We have recently learned about the secret contacts, running from the 1950s until recently, between the CIA and Crypto AG, a leading Swiss supplier of cryptographic equipment. This granted Americans access to internal communications of many governments, with Brazil continuing to buy Crypto AG equipment for its armed forces until 2019. During Dilma Rouseff’s years in office, there was a lot of talk about technological sovereignty and the need to lessen Brazil’s dependence on the US – a discourse that is not new to Brazil, as it allowed the country, even during the dictatorship era, to make some advances in computing and manufacturing. How much remains of that sovereignty discourse? Or has the “technological sovereignty” of nation states been overtaken by the discourse of the “self-sovereignty” of crypto-armed individuals?

I have to admit that, sadly, this discourse just vanished from prominent spaces of power in Brazil in recent years, even if the mainstream media was not very prone to feature it in the first place. Of course, it still resonates in left spaces and some sectors of the intelligentsia, although not strongly enough, especially considering everything that has happened during these years.

Bolsonaro’s policy of full and subjugated geopolitical alignment with the US is a shame for a country that has a tradition of some diplomatic independence and a very important role to play in international affairs. What is worse, this is a president who built his political capital through chauvinistic nationalism. This surely did provide the grounds, at least to some extent, for the self-sovereignty discourse of crypto-armed individuals, although I don't see this as the most relevant trend in this regard.

After all, Brazil has had a strong and vibrant community around digital privacy, digital rights, and free software. These people are still alive and trying to do their best given the situation. It is striking, however, that, alongside this almost complete surrender of nation-state sovereignty, Brazilians have also passively accepted being deprived of control over their data, their privacy, and their rights. Of course, this is a matter for collective – not individual – action. I hope we will eventually wake up before it is too late.

Edemilson Paraná is an assistant professor in Economic Sociology and Sociology of Work at the Department of Social Sciences/Graduate Program in Sociology at the Federal University of Ceará, Brazil, and assistant professor at the Graduate Program in Comparative Studies on the Americas at the University of Brasília, Brazil. He has published in the areas of Economic Sociology, Political Economy, and Social Theory, and is also the author of the books Digitalized Finance: Financial Capitalism and Informational Revolution (Brill, 2019/Haymarket, 2020) and Money and Social Power: A Study on Bitcoin (Brill, forthcoming).